Insights

October 12, 2023

Materials are the building blocks of our world. Within the context of the energy transition, a sub-group of materials dubbed “critical minerals” has been the subject of significant media, policy, and business attention for their increasing importance in our energy systems. Governments have rushed to design their own critical mineral strategies and publish lists of minerals they deem essential to their economy and national security. These minerals have varying degrees of scarcity and have properties that make them uneconomic or challenging to replace in energy transition technologies or industrial processes.

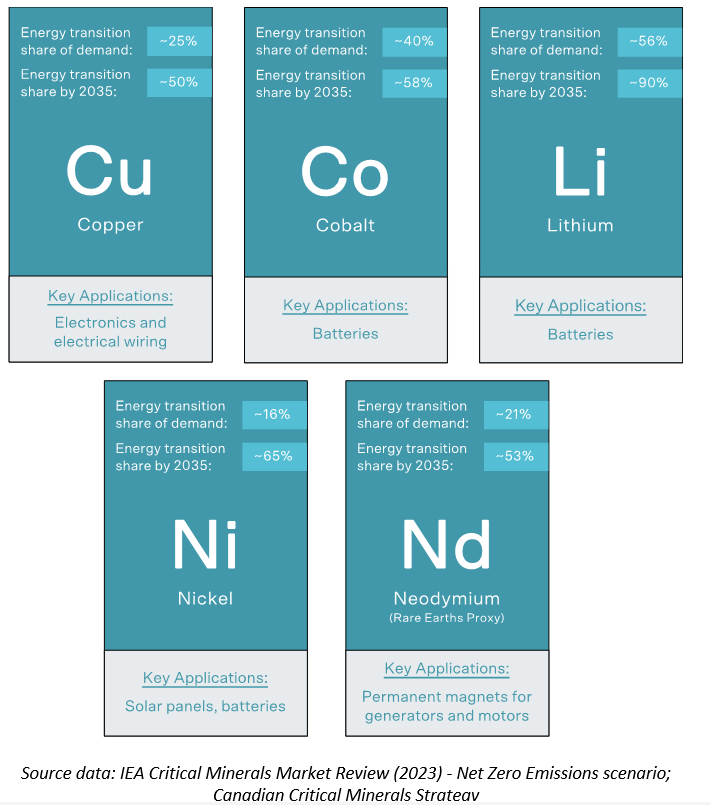

Canada, the EU, the USA, South Korea, Japan, Australia, South Africa, India, and the UK reference 49 different minerals they consider critical ii. To focus our analysis, we will touch on five critical minerals that are central to the energy transition: copper, cobalt, lithium, nickel, and the rare earth elements (largely neodymium). These minerals are not only critical to the energy transition technologies that we’ve deployed to date: their markets will also be increasingly driven by energy transition dynamics as the share of each of their supply demanded by the energy transition is expected to expand aggressively by 2035 iii.

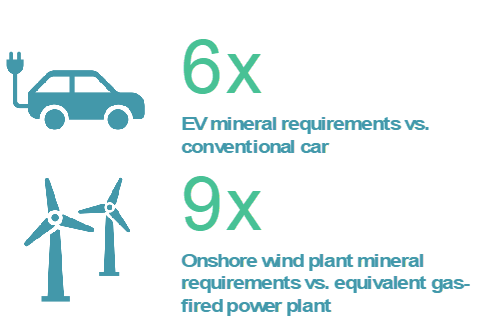

The demand growth is a direct result of the specific technologies being deployed and the critical minerals that underpin them. These technologies are typically more mineral intensive than existing hydrocarbon-based technologies (see graphic below iv). For example, copper represented about half of the mineral demand in solar deployments in 2022 (682 kt) and solar’s copper needs will triple by 2035 in the IEA’s Net Zero by 2050 base case. Another example – electric vehicle (EV) deployments in 2022 – required 373 kt of copper (~25% of total EV mineral demand), and 325 kt of nickel (~22% of total EV mineral demand).

Supporting projected EV growth in the same base case sees demand for these minerals growing by a factor of 10 by 2035. And while lithium, cobalt, and neodymium each represented less than 5% of EV mineral demand in 2022, they are key parts of the battery and motor, and the IEA sees EV demand growing by 14 times for lithium, 8 times for neodymium, and 3.5 times for cobalt by 2035 in their Net Zero by 2050 base case.iv Just keeping up with the pace of announced battery gigafactories in North America (over 1,000 GWh planned for this decade) will require a 10x increase in the regional supply of battery minerals, according to the American Department of Energy v.

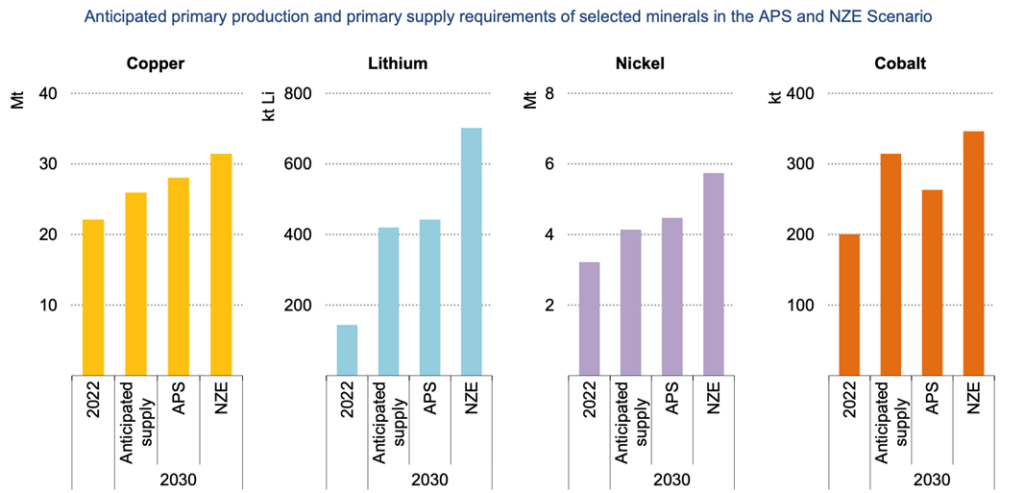

From a more holistic view, based on 2022’s global production, we need to produce approximately 50% more copper, two and a half times the cobalt, nearly 9 times the lithium, two and a quarter times the nickel, and two and a quarter times the neodymium to be on track for a Net Zero by 2050 scenario – all by 2035 vi. In a more conservative scenario that tracks stated national decarbonization-related policies, we would still need to produce 24% more copper, 50% more cobalt, more than 3 times the lithium, over 40% more nickel, and over 50% more neodymium by 2035. This demand growth presents significant challenges to extraction, processing, and refining industries that face major capital, regulatory, and other barriers.

To meet this demand, policymakers are paving the way by developing national objectives, frameworks, incentives, and financing mechanisms. Major steps forward include the European Union’s Critical Raw Materials Act, the United States’ Inflation Reduction Act (IRA), and Australia and Canada’s respective Critical Minerals Strategies, among a myriad of other policies enacted in the last few years. By setting clear strategies, these and other nations help spur private capital and innovation while fostering domestic supply chains in strategic industries.

The IRA’s consumer purchase tax credit (known as 30D) for EVs is a telling example of the importance placed on supporting domestic critical mineral supply chains: where the $7,500 tax credit used to apply to any EV purchase, it now includes two separate $3,750 tax credits related to critical mineral sourcing and battery component sourcing. To be eligible for the EV critical mineral-related tax credit, the automaker must have sourced at least 40% of the critical minerals in the car from the U.S or a Free Trade Agreement Partner. That requirement ramps up to 80% in 2027 and stipulates that no critical minerals can be sourced from Foreign Entities of Concern by 2025 (China, Russia, North Korea, Iran).

The IEA’s flagship report in 2021 on the Role of Critical Minerals in Energy Transitions highlighted a looming shortfall in the supply and availability of critical minerals. At the time, in a scenario consistent with climate goals, supply in 2030 from existing mines and projects under construction was only sufficient to meet half of projected lithium and cobalt needs and 80% of copper. Since then, mining majors have invested more than $70B in the development of critical minerals – representing annual increases of 20% and 30% in 2021 and 2022, respectively. In Canada, the government produces a tracker of all critical mineral projects, with major recent milestones including Ford, GM, and Stellantis investing in new battery and electric vehicle production, and an emerging battery materials hub in Bécancour, Quebec following investments by BASF, GM, NanoOne, and POSCO. vii

APS’ means ‘Announced Pledges Scenario’, ‘NZE’ means ‘Net Zero Emissions by 2050 Scenario’

Source: IEA Critical Minerals Market Review (2023)

It’s clear from the chart above that the output gap is narrowing. And while there has been notable progress in only a couple of years, such a high-level view can obscure significant discrepancies in individual commodity markets. Current projected supply also falls meaningfully short of a scenario consistent with net zero emissions by 2050. Supply is also notoriously hard to bring online and faces significant hurdles at every level from extraction to refining and processing; bringing a mine from initial exploration to production can take over a decade. Announcing and even beginning construction is no guarantee a project will be delivered within the expected time frame, or at all.

A high-level view also ignores the degree of supply concentration in critical minerals, which poses a risk to the availability and security of the critical mineral supply chain. The top three mining countries represent 91% of lithium, 80% of cobalt (the Democratic Republic of Congo alone is 70%), 90% of graphite, and 86% of rare earth elements production. In processing, the top three countries make up 97% of lithium, 99% of cobalt, 100% of graphite (China controls ~98% viii) and 100% of neodymium ix. In most cases, China controls a disproportionate amount of the world’s critical mineral supply chain, posing risks in a more polarized geo-political world.

To decarbonize our economy, clean technologies also need to be abundant and affordable. Over the past two years, the average price for batteries, wind turbines, and solar power (per installed MW) began to trend upward – bucking over five years of consistent cost declines, in large part due to rising critical minerals costs. The cost of cathode materials (such as lithium, nickel, and cobalt) now comprises almost 40% of a lithium-ion battery pack, up from less than 10% only five years ago x.

It’s clear that we need to continue to invest both in scaling mining, processing, and refining of critical materials. But we also need to invest in innovation to do so more quickly, more efficiently, to re-use more of what has already been produced, and in some cases, reduce the need for critical minerals in certain technologies xi – all with an eye toward developing regional supply chains that leverage national policies, interests, and strengths.

We are seeing promising trends in fostering innovation in the critical mineral supply chain: increasing numbers of growth-stage companies poised to scale their technology and IP in North America and abroad. We’re seeing companies with proven technologies designed to enhance lithium extraction yields from mining projects. Others are attacking rare earths and battery material supply challenges by developing recycling technology to extract materials from permanent magnets. Some are even finding ways to tap mineral deposits that would otherwise be uneconomic or overly wasteful to mine through precision ‘smart’ mining – these and other approaches are key to doing more with less, creating a more environmentally friendly extraction industry.

While we cannot precisely predict what the critical minerals demand and supply will look like in 10, 20, or 30 years, it remains abundantly clear that critical minerals will play a leading role in the energy transition, and that firms – and nations – that invest with foresight will be well compensated in an electrified economy. It’s also clear that there are multiple approaches and partners needed across the entire critical mineral value chain. We will need investors, policymakers, and entrepreneurs to take long-term views to help move forward capital-intensive production and processing projects. On the other hand, we will also need innovation-focused investors and entrepreneurs with a vision for more efficiently accessing, developing, recycling, and integrating critical minerals in the North American supply chain.

i Department of Energy, 2023. Electric Vehicle Battery Manufacturing Capacity in North America in 2030 is Projected to be Nearly 20 Times Greater than in 2021. https://www.energy.gov/eere/vehicles/articles/fotw-1271-january-2-2023-electric-vehicle-battery-manufacturing-capacity

ii The Canadian Critical Minerals Strategy (https://www.canada.ca/en/campaign/critical-minerals-in-canada/canadian-critical-minerals-strategy.html#)

iii IEA Critical Minerals Data Explorer (https://www.iea.org/data-and-statistics/data-tools/critical-minerals-data-explorer)

iv Data from IEA; The Role of Critical Minerals in Energy Transitions (2021). (https://www.iea.org/reports/the-role-of-critical-minerals-in-clean-energy-transitions)

v Department of Energy: Sector Spotlight (Critical Minerals), 2023. https://www.energy.gov/lpo/articles/sector-spotlight-critical-materials

vi IEA: Critical Minerals Market Review (2023). (https://www.iea.org/reports/critical-minerals-market-review-2023)

vii The Canadian Critical Minerals Strategy (https://www.canada.ca/en/campaign/critical-minerals-in-canada/canadian-critical-minerals-strategy.html#)

viii Reuters (2023): Auto firms race to secure non-Chinese graphite for EVs as shortages loom. https://www.reuters.com/business/autos-transportation/auto-firms-race-secure-non-chinese-graphite-evs-shortages-loom-2023-06-21/

ix IRENA (2023): Geopoitics of the Energy Transition: Critical Minerals. https://www.irena.org/Publications/2023/Jul/Geopolitics-of-the-Energy-Transition-Critical-Materials

x IEA: Critical Minerals Market Review (2023). (https://www.iea.org/reports/critical-minerals-market-review-2023)

xi A 2022 report by SINTEF, a European think-tank, found that shifting technology choices alone (ex: different EV battery chemistries) could lower demand for critical minerals in the IEA’s Net Zero scenario by 30% in 2050. https://sintef.brage.unit.no/sintef-xmlui/bitstream/handle/11250/3032049/CircularEconomyAndCriticalMineralsReport.pdf?sequence=7&isAllowed=y

xii Sources: MP Company materials; Reuters, Canaccord Equity Research, BMO Equity Research