Insights

October 26, 2021

Under Bloomberg New Energy Finance (BloombergNEF)’s Economic Transition Scenario, primarily driven by techno-economic trends and market forces while assuming no new enacted policies, annual passenger electric vehicle (EV) sales are estimated to more than triple by 2025, to 21 million, and rise to 80 million in 20503. The largest market served by battery manufacturers are EVs, outranking stationary storage and consumer electronics. EVs have almost entirely been powered by lithium-ion batteries, which is expected to continue for the foreseeable future. The projected growth in the EV market has led to increased demand for stronger performing and lower cost lithium-ion batteries.

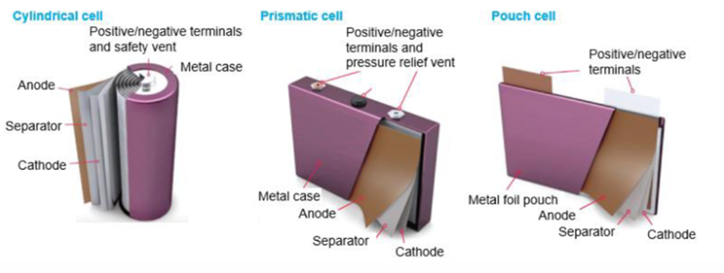

The basic components of a lithium-ion battery include the cathode, anode, electrolyte, and separator. Lithium ions move from the anode to the cathode when a battery is discharging, and vice-versa when charging. The electrolyte carries the lithium ions between the anode and the cathode, through the separator. The latter prevents contact between the two materials to avoid a short circuit, while facilitating the flow of the lithium ions. Battery cells are manufactured in three main form factors, namely cylindrical, prismatic, and pouch cells. The cell design is influenced by its technical requirements, the cost, and the cathode chemistry4.

Source: LG Energy Solution

Source: BloombergNEF

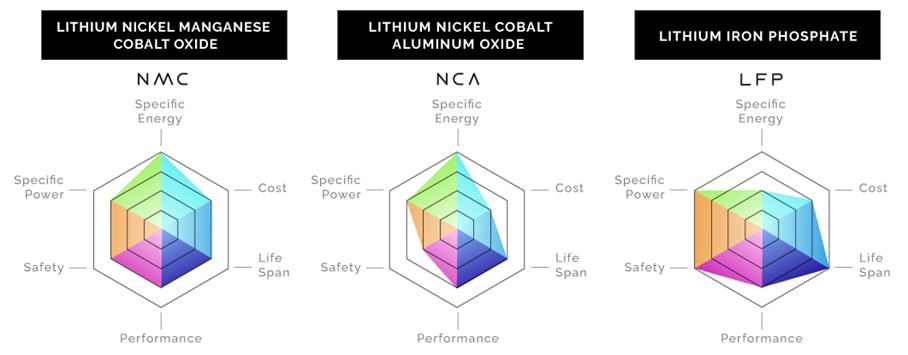

Manufacturers are working towards the next-generation of lithium-ion batteries through innovations in cathode chemistries, anode chemistries, and electrolyte technologies. Cathode materials are the key performing drivers of lithium-ion batteries determining metrics such as specific energy versus specific power, safety, cost competitiveness, cycle life, and weather performance, thus driving a higher portion of the cell costs. Specific energy, or gravimetric energy density, refers to the available energy per unit mass of a substance. Specific power or gravimetric power density indicates loading capability, defining the current that is drawn from the battery. Power relates to current delivery measured in watts (W) and energy is the power over time measured in watt-hours (Wh)5.

The Li-on technologies most commonly used in EVs are Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), and Lithium Iron Phosphate (LFP). The optionality between these cathode chemistries presents a trade-off with respect to each performance dimension, per below.

Source: Visual Capitalist Elements

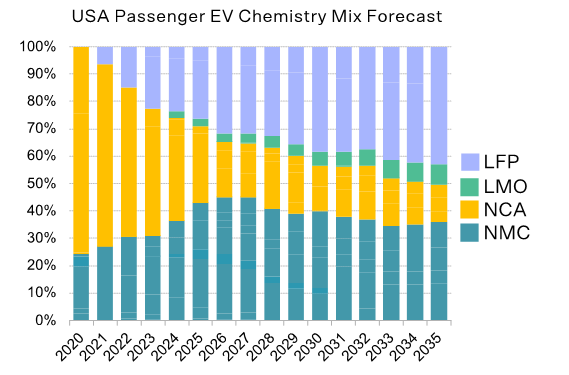

In 2022, NMC batteries were the dominant chemistry for EVs representing a market share of 60%, per International Energy Agency6. The use of nickel enables high energy density allowing for more driving range and fast charging performance, particularly in cold climates. The use of manganese yields a stabilizing component in the cathode, both improving the aforementioned dimensions as well as decreasing the combustibility of the battery pack, reducing the reliance on cobalt. That being said, NMC batteries remain susceptible to thermal runaway, similar to other Li-on batteries, due to the lithium plating on the anode during its overcharge. Additionally, the use of nickel and cobalt has meaningful supply chain challenges that can result in input price volatility and lower cost competitiveness. NCA batteries are similar to NMC, sharing the nickel-based advantages such as high energy and power density. While the chemistry uses aluminium in place of manganese to yield stability, NCA batteries are typically more expensive given the ratio of nickel and cobalt. They are typically used in high-performance EV models. Tesla’s first battery option was NCA, while majority of the auto industry opted for NMC7. Many EV OEMs are shifting towards the use of LFP batteries, which have a greater abundance of domestically available materials sourced at a lower cost8. Iron and phosphate introduce a longer life cycle and less thermal runaway risk but offer less driving range and higher sensitivity to cold climates9,10. The below graphic represents the BloombergNEF’s cathode chemistry outlook.

Source: BloombergNEF

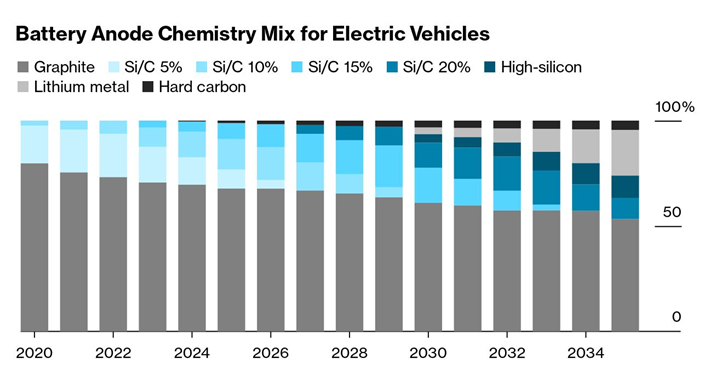

Assessing anode technologies, about 70% are graphite-only today, per the visual below. This is due to its well understood performance driven by its low cost, stable structure, and high electrical conductivity. Silicon is expected to play an important role in high-performance cells in the years to come driven by its ability to improve energy density. However, to date it has been hindered by the swelling and contraction caused to the anode, limiting the battery’s life cycle. In the long-term, lithium-metal anodes, supported by solid state electrolytes, are expected to account for a larger share of the market due to the high energy density they provide. Hard carbon anodes is newly considered as part of the technology mix outlook, which have the advantage of high capacity, low price, and low working voltage.

Source: BloombergNEF

Note: Si/C refers to silicon-graphite composite anodes, with the silicon percentage expressed alongside. High silicon refers to anodes using more than 50% silicon.

Ultimately, lithium is used at the base of all Li-ion batteries but remains costly and raises challenges with the vast majority of refining capacity residing in China, accounting for nearly 60% of the world’s lithium chemical supply per the International Energy Agency11.

As it pertains to stationary storage, most deployments are currently lithium-ion given that the use cases are best suited for short duration batteries (i.e., sub 4-hour durations) namely, peak shaving, time-of-use arbitrage, and mobility.12 However, there are many use cases such as grid services or direct current fast charging (DCFC) which befit high power batteries (i.e., sub 1-hour durations) whereby supercapacitors, sodium-ion, or flywheel technologies may be better suited over time13. Long duration batteries (i.e., 12+ hour durations) target applications such as seasonal storage of intermittent renewable power at high levels of penetration, for which technologies such as zinc-air, iron-air, or compressed air14 are likely best suited. Each technology will have their respective hurdles to address prior to use at scale15.

Battery demand is largely being driven by the global shift from ICE vehicles to EVs as well as the need for stationary storage systems alongside the growth of renewable energy. Per BloombergNEF, the base case for global battery demand is currently estimated at ~1,000 GWh/year which is forecasted to increase to nearly ~6,000 GWh/year by 2035, with approximately 23% projected to be commissioned in North America16. The addressable market is mobility-driven, with stationary storage accounting for approximately 8% of global demand between 2023-2035, in line with North America at 9% of demand over the same period.

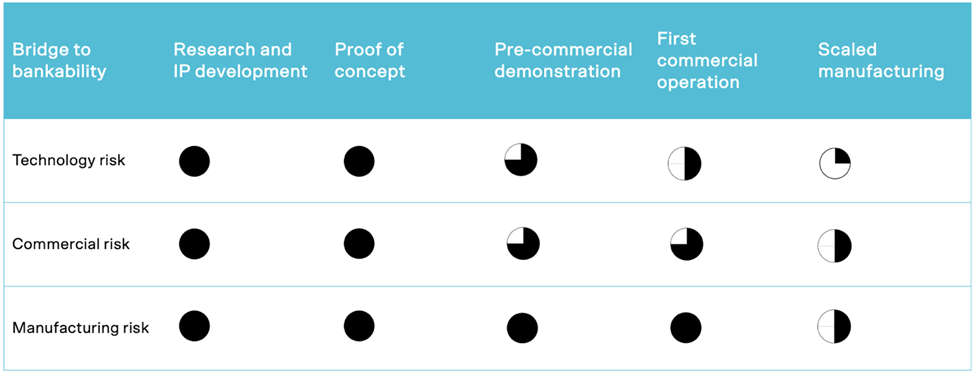

Announcements for the construction of battery manufacturing facilities are seen published in abundance, as innovators push to create the winning chemistry for potential off-takers. Market players are committing to demonstration facilities aiming to validate technologies on the path towards commercialization, ultimately looking to commission giga-factories to manufacture at scale. Newcomers in the industry face challenges along this life cycle, whereby raising outside capital to achieve proof of concept is critical to pivot from the research and IP development phase. From there, innovators must attract diverse sources and raise a large quantum of capital at pre-revenue stages without demonstrated manufacturability and unit economics to build out a first commercial operation. The below diagram highlights the various risks throughout a battery innovator’s life cycle:

Source: MKB

Incumbents are already producing battery cells at 95% capacity17, presenting difficulty to keep pace with innovation. Per BloombergNEF data, the average factory size is shifting from 5.7 GWh to 11.3 GWh once announced capacity is built, with potential up to ~15 GWh. Consolidation down the road is likely, but how is yet to be determined based on successful project execution and contracts secured. Notable announcements in Canada include Stellantis and LG Energy’s joint venture amounting to CA$5B for a 45 GWh facility in Ontario18 and NorthVolt’s 60 GWh facility in Quebec calling for a CA$7B investment19. According to Benchmark Mineral Intelligence, there are at least 37 battery plants in operation or planned commissioning in the US and Canada as of October 2023, representing 1.3 TWh of annual manufacturing capacity20 with majority of announced battery plant projects scheduled to begin production between 2025 and 203021. For reference, 1.3 TWh is enough to power more than 10 million electric vehicles a year, pointing to the challenges innovators face with large-scale manufacturers both locally and most dominantly in China, home to 10 of the largest battery manufacturers or 77% of the global capacity22. Moving forward, North American projections compete with an estimated 291 existing or planned battery factories in China, representing 6.1 TWh of annual production capacity, according to Benchmark Mineral Intelligence23. A large driver of this North American market activity is the IRA’s domestic content requirements, which require the reshoring of battery component manufacturing and assembly processes, as well as the extraction, processing, and recycling of critical minerals. This is enabling the development of EV production in North America and “friend-shoring” of EV supply chains in allied countries24. The impact on EV sales is yet to be determined as they depend on battery qualification for the credit and the minerals that go into them are in short supply25.

The capital stack for these North American projects is top of mind for the local constituents. With funding needs in the hundreds of millions to billions of dollars, government grant and tax incentive allocations will be a key driver – no infrastructure was ever built without policy intervention. Debt providers and loan programs such as the Department of Energy’s (DOE) Loan Program Office (LPO) will play an important role in reducing the risk surrounding the initial outlay by investors on the cap table as high capital expenditure requirements are driving high valuations. With revenue generation a few years out on the horizon, the equity cheques will need to come from the right players. Private investments will round out the capital stack, supporting today’s battery manufacturers financially and strategically. Notably, manufacturers will require support on the optimization of battery production and facility construction, as well as battery management and control post-manufacturing, introducing ripe opportunity for innovation from industry supporting software businesses.

1 https://www.whitehouse.gov/wp-content/uploads/2022/12/Inflation-Reduction-Act-Guidebook.pdf

2 https://www.budget.canada.ca/2023/pdf/budget-2023-en.pdf

3 https://about.bnef.com/blog/the-road-to-electric-car-supremacy-in-five-charts/

4 https://www.bnef.com/insights/31701/view (Technology Radar: Next-Generation Battery Anodes)

5 https://batteryuniversity.com/article/bu-105-battery-definitions-and-what-they-mean

6 https://www.iea.org/reports/global-ev-outlook-2023/trends-in-batteries

7 https://www.cnbc.com/2020/06/30/tesla-and-the-science-of-low-cost-next-gen-ev-million-mile-battery.html#:~:text=Tesla’s%20primary%20EV%20battery%20technology,manganese%2Dcobalt)%20battery%20chemistry.&text=Nickel%20currently%20ranges%20in%20price,half%20the%20price%20of%20cobalt.

8 https://www.forbes.com/sites/samabuelsamid/2023/08/16/lithium-iron-phosphate-set-to-be-the-next-big-thing-in-ev-batteries/?sh=bca5bbb7515f

9 https://zecar.com/reources/what-are-lfp-nmc-nca-batteries-in-electric-cars#NCA%20batteries

10 https://elements.visualcapitalist.com/the-six-major-types-of-lithium-ion-batteries/

11 https://www.cnbc.com/2022/11/23/china-played-a-great-game-on-lithium-and-weve-been-slow-to-react-ceo.html

12 https://www.ctvc.co/ldes-long-duration-energy-storage-tech/

13 https://www.linkedin.com/advice/1/what-current-emerging-applications-markets-flywheel

14 https://cleantechnica.com/2023/06/02/long-duration-energy-storage-is-key-to-cleaning-up-the-power-grid/

15 https://builtin.com/hardware/new-battery-technologies

16 BloombergNEF – Lithium-Ion Batteries State of the Industry 2023

17 https://www.mckinsey.com/industries/industrials-and-electronics/our-insights/unlocking-the-growth-opportunity-in-battery-manufacturing-equipment

18 https://www.stellantis.com/en/news/press-releases/2022/march/stellantis-and-lg-energy-solution-to-invest-over-5-billion-cad-in-joint-venture-for-first-large-scale-lithium-Ion-battery-production-plant-in-canada

19 https://www.reuters.com/business/autos-transportation/swedens-northvolt-build-52-bln-battery-factory-canada-2023-09-28/

20 https://www.reuters.com/business/autos-transportation/toyota-lg-energy-sign-battery-supply-agreement-power-evs-2023-10-04/

21 https://www.energy.gov/eere/vehicles/articles/fotw-1271-january-2-2023-electric-vehicle-battery-manufacturing-capacity#:~:text=A%20wave%20of%20new%20planned,production%20between%202025%20and%202030.

22 https://elements.visualcapitalist.com/chinas-dominance-in-battery-manufacturing/#:~:text=With%20nearly%20900%20gigawatt%2Dhours,world’s%2010%20biggest%20battery%20makers.

23 https://www.reuters.com/business/autos-transportation/toyota-lg-energy-sign-battery-supply-agreement-power-evs-2023-10-04/

24 https://siepr.stanford.edu/publications/policy-brief/clean-vehicle-tax-credit-new-industrial-policy-and-its-impact

25 https://www.technologyreview.com/2022/08/02/1056606/ev-tax-credits-battery-supply/